Heather Boushey, Chief Economist, Investing in America Cabinet

Justina Gallegos, Deputy Director for Industrial Innovation, Office of Science and Technology Policy

In 2021 and 2022, President Biden signed into law his Investing in America agenda, a series of strategic public investments in industries critical for the long-run economic growth of the United States. This included the largest investment in reducing carbon emissions in American history. The clean energy investments in the agenda—primarily in the Bipartisan Infrastructure Law and the Inflation Reduction Act—include incentives for manufacturing across the clean energy supply chain, investments in demonstration projects, loans and loan guarantees for a variety of technologies, and production and investment tax credits for clean energy generation. This suite of public sector tools provides unprecedented investment certainty to the private sector, with several provisions of the Inflation Reduction Act extending over a decade.

The most recent available data indicate that the President’s agenda has supported robust investment in the construction of manufacturing facilities and strong performance in key targeted industries including solar and wind energy, grid energy storage, and electric vehicles.

This brief highlights progress-to-date towards deploying these clean energy technologies. It describes how the President’s Investing in America agenda is translating into tangible outcomes and progress towards the President’s climate goals, and it outlines how the deployment of clean energy technologies will lower greenhouse gas emissions, improve energy security, and spur economic growth.

Investment in the construction of clean energy manufacturing facilities is exceeding expectations

As explained in a recent issue brief, the Investing in America agenda is intended to catalyze strategic private sector investments, and initial signs indicate that private companies are already responding. Since January 2021, private companies have announced over half a trillion dollars in new investment, including nearly $360 billion in clean energy manufacturing, EVs and batteries, and power generation.

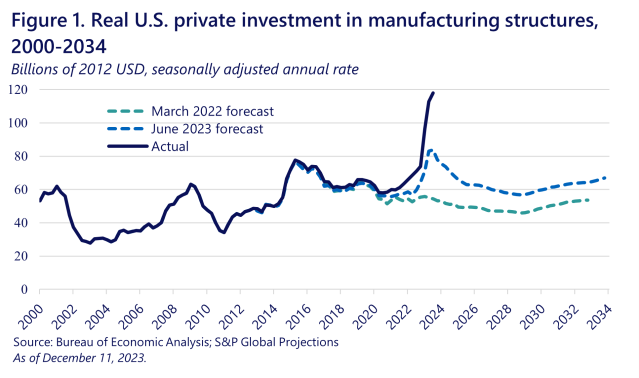

One of the first ways these private clean energy investments will be visible in the economic data is through the construction of manufacturing facilities. Indeed, since President Biden took office, inflation-adjusted spending on the construction of manufacturing facilities has nearly doubled. This increase has exceeded forecasters’ expectations, suggesting that the Investing in America agenda is catalyzing more private sector funding than initially expected (Figure 1).

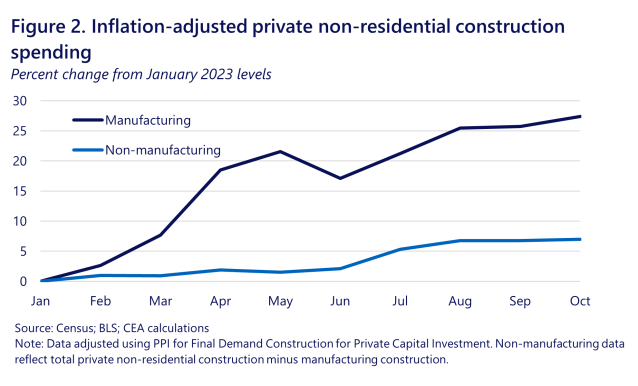

This growth in the construction of manufacturing facilities is strong relative to growth in other forms of construction. For example, inflation-adjusted manufacturing construction spending increased by 27 percent in the first ten months of 2023. Meanwhile, other types of non-residential construction grew 7 percent over the same period (Figure 2).

The Investing in America agenda is driving clean energy deployment

Other data sources indicate that the public clean energy investments in the President’s Investing in America agenda will translate into unprecedented private sector clean energy deployment in the coming years. In many cases, the acceleration is much faster than forecasters had previously anticipated.

Clean energy deployment

A central goal of the Investing in America agenda is to increase the amount of energy generated from clean sources like solar and wind, which will lower energy costs, improve energy resilience, and cut greenhouse gas emissions. Near-term investments in manufacturing, coupled with incentives like tax credits, are intended to reduce the costs of deploying clean energy at scale.

There has already been notable progress towards expanding U.S. solar and wind manufacturing capacity. Since the Inflation Reduction Act was signed into law in August 2022, over 100 gigawatts of planned manufacturing capacity have been announced for solar module assembly—which would produce enough solar panels per year to power more than 10 percent of U.S. homes. These announcements represent 79 new facilities and/or expansions and more than $13 billion in investment.

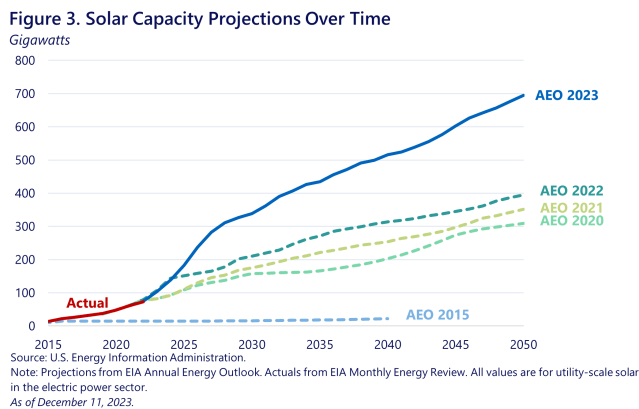

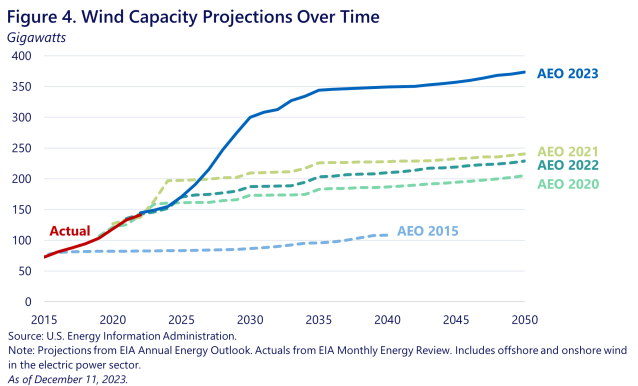

As the manufacturing base expands, solar and wind deployment are projected to grow rapidly—considerably faster than projections before the Investing in America agenda was signed into law. According to the latest Annual Energy Outlook (AEO) forecast[1] from the U.S. Energy Information Administration, the United States is on track to have 338 gigawatts of solar capacity in 2030—nearly twice the capacity forecasted in the beginning of 2021 (Figure 3).[2] Likewise, for wind energy capacity, the latest AEO forecast estimates that the United States will have 300 gigawatts of wind turbine capacity in 2030, a 43 percent increase from their 2021 projection (Figure 4). For context, this estimated capacity from solar and wind in 2030 would be roughly double the total existing renewable capacity on the grid at the end of 2022.

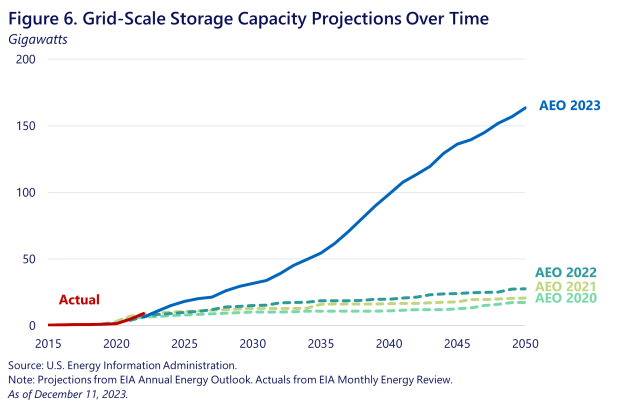

Grid-scale energy storage deployment

Energy storage is another essential component of a clean electricity grid. Battery storage—either via grid-scale battery systems or an aggregation of smaller batteries in a virtual power plant—enables companies to store excess electricity from wind and solar energy and put that energy back on the grid when it is needed the most, helping to reduce total energy costs.

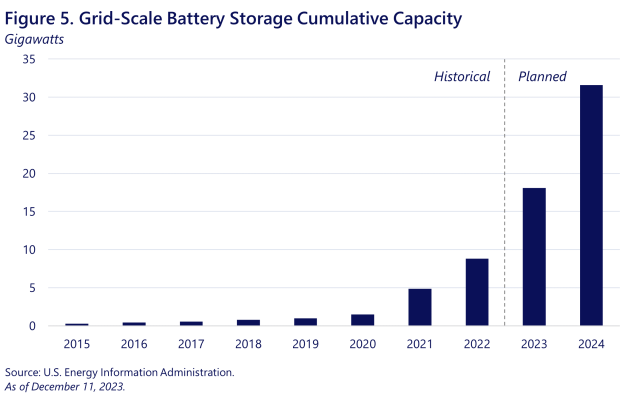

To grow the amount of energy storage on the grid, incentives from the President’s Investing in America agenda are spurring historic private deployment of large-scale energy storage capacity. Thanks to cost declines in battery energy storage, in just one year, grid-connected battery energy storage is on track to more than double. It is expected to nearly double again in 2024 (Figure 5). The latest forecasts, following the passage of the Bipartisan Infrastructure Law and the Inflation Reduction Act, show a dramatic expansion in capacity for grid-scale battery storage, far outpacing previous estimates (Figure 6). As of August 2023, grid-storage battery capacity is ahead of even this 2023 estimate.

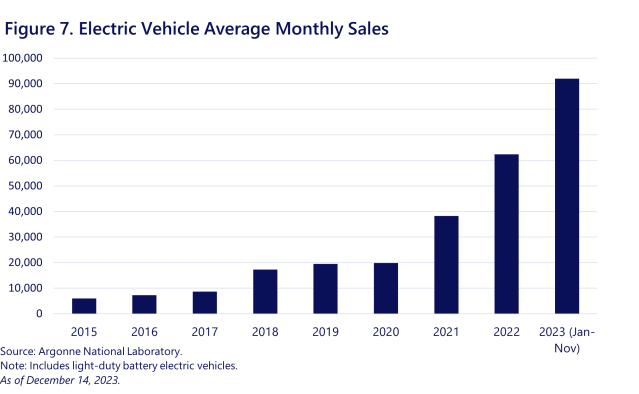

Electric vehicle sales

The large-scale adoption of electric vehicles (EVs) can lower energy costs, improve air quality, cut emissions pollution, and reduce noise pollution. Throughout the United States, it is cheaper to charge a vehicle using electricity than to fill it with gasoline. The average EV in the United States produces fewer emissions than the average new gasoline-powered vehicle, even when accounting for the current electricity mix of the U.S. grid. The Inflation Reduction Act is projected to double the share of clean electricity generation by 2030, further lowering the total carbon footprint of current and future electric vehicles as the grid becomes cleaner.

To reap the benefits of this technological innovation, the Investing in America agenda includes a range of incentives designed to support the EV industry. This includes investments to support EVs and EV battery manufacturing, funding to build a national network of EV chargers, and consumer tax credits to lower the cost of purchasing an EV. Private sector companies have begun to respond to these incentives. Since the beginning of 2021, firms have announced over $150 billion in investments to manufacture EVs and EV batteries. New EV models are also offering consumers more options. Between 2021 and the second quarter of 2023, the number of EV models increased from 34 to 55, with 14 new EV models in the last year alone.

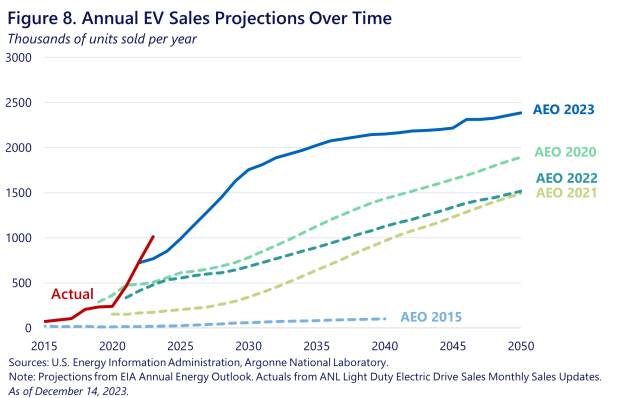

EV sales have risen rapidly during this period from roughly 20,000 sales per month in 2020 and 2019 to over 90,000 per month in 2023 (Figure 7). At the start of 2023, forecasters estimated that beginning in 2026, more than one million EVs would be sold each year, and by 2030, nearly 1.8 million EVs would be sold—more than five times the forecast in 2021 (Figure 8). Actual sales have surpassed these forecasts. More than one million EVs have already been sold in 2023—three years ahead of the projections made earlier this year and 18 years ahead of the projections made in the beginning of 2021.

Clean energy deployment builds a better economy for Americans

Manufacturing and deploying clean energy technologies enables the United States to move faster towards the Biden-Harris Administration’s climate goals. Meeting these goals means reducing the impacts of climate change by cutting emissions, improving energy security and reliability, and spurring equitable economic growth. Some of these investments are spread out over a decade, meaning many of the associated benefits will accrue over time. Forecasters’ estimates preview some of these benefits to come.

First, more rapid deployment means more rapid progress towards preventing and mitigating the impacts of climate change. According to the most recent U.S. government forecast, U.S. emissions could fall nearly twice as much by 2030 compared to before the Inflation Reduction Act and Bipartisan Infrastructure Law were in place. To the extent that deployment is indeed faster than originally anticipated, these emissions projections would improve even more.

Second, deploying clean energy can improve U.S. energy security and reliability while lowering energy prices. According to the U.S. Department of Energy, the share of electricity from clean sources in 2030 could grow to 80 percent—nearly twice the expected amount before the Inflation Reduction Act passed. Strong growth in domestic clean energy industries supports energy security, reliability, and supply chain resiliency while creating good jobs. Deploying more clean electricity sources will provide opportunities to increase energy system reliability and security by reducing overreliance on traditional fuel sources alone. Increased long-duration energy storage capacity can also reduce outages and improve energy reliability. Meanwhile, new technologies like virtual power plants and other distributed energy resources can improve overall grid reliability. Similarly, the transition to electric vehicles can reduce U.S. consumers’ exposure to macroeconomic shocks from oil price volatility.

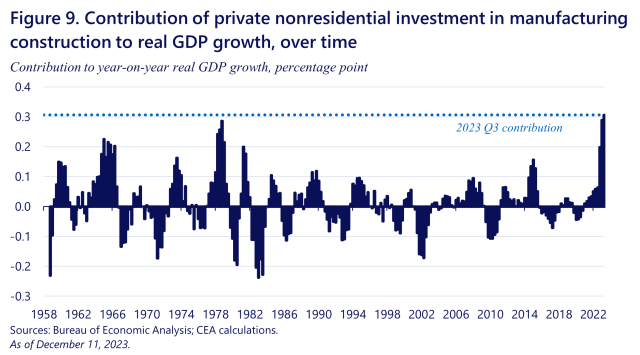

Third, investments in clean energy can contribute to long-term broad-based economic growth. In the aggregate, strong investments in manufacturing construction are contributing to GDP growth (Figure 9). In the latest data, private manufacturing facility construction contributed 0.3 percentage points to the total 3.0 percent real four-quarter growth. This means manufacturing construction accounted for roughly 10 percent of all GDP growth over the year, the largest annual contribution to GDP growth since the U.S. government began collecting these data in 1959.

In the long-run, these investments in clean energy are likely to pay for themselves in terms of the benefits accrued. According to a recent analysis, a dollar of spending on clean energy generates roughly twice as much in output as a dollar in spending on fossil fuel energy. A more recent working paper estimates that the production tax credit in the IRA will boost U.S. GDP by lowering the cost of electricity, meaning it generates more benefits than it is expected to cost—without even counting the benefits from reduced carbon emissions and air pollution.

Conclusion

In order to meet the Biden-Harris Administration’s ambitious climate goals, the United States needs to deploy clean energy at an unprecedented scale. To lower emissions across sectors like power generation and transportation, there is a need for generational investments in not only clean power generation but also related technologies like grid-scale energy storage and electric vehicles.

President Biden’s Investing in America agenda responds to this need with carefully designed incentives to mobilize private sector investments, including in clean energy technologies. At the macroeconomic level, there is already strong evidence that private sector commitments are translating into tangible construction projects to build new manufacturing facilities.

In critical clean energy industries, the latest available data indicate that the Investing in America agenda is enabling the United States to outpace previous projections of the rate at which the country would move towards its clean energy goals. Current data suggest the United States is moving rapidly towards a clean energy economy, even faster than many forecasts—both forecasts prior to the enactment of the President’s agenda and, for some technologies, forecasts immediately after the enactment of the agenda—had anticipated.

Ultimately, these investments will improve the economic and social wellbeing of Americans. Greater manufacturing capacity and deployment of clean energy, energy storage, and electric vehicles translate into lower greenhouse gas emissions, improved energy security and reliability, lower costs, and stronger economic growth in the long run.

Together, these latest data show that the President’s Investing in America agenda is already generating benefits—economic and otherwise—to the American people. Looking ahead, the latest forecasts suggest these investments are mobilizing more activity than previously anticipated, putting the United States even closer towards its goals of addressing climate change, promoting energy security, and generating steady, stable economic growth.

[1] The 2023 forecast uses case assumptions frozen in mid-November 2022, so it incorporates the Bipartisan Infrastructure Law and Inflation Reduction Act (except for certain provisions where guidance was not yet available). The 2022 forecast includes the Bipartisan Infrastructure Law but not the Inflation Reduction Act.

[2] This does not include small-scale solar power systems, such as those on residential rooftops, which accounted for 40 gigawatts of additional solar capacity in 2022.

Official news published at https://www.whitehouse.gov/briefing-room/blog/2023/12/19/building-a-thriving-clean-energy-economy-in-2023-and-beyond/

The post Building a Thriving Clean Energy Economy in 2023 and Beyond first appeared on Social Gov.

More Stories

Statement from Vice President Kamala Harris on One Million Public Service Workers Receiving Student Debt Cancellation

Remarks by President Biden and First Lady Jill Biden at an Italian American Heritage Month Reception

Remarks by President Biden at a Memorial Service for Mrs. Robert F. Kennedy